Public benefits or assistance: many such public benefits, such as unemployment compensation, worker's compensation, aid to families with dependent children, general assistance, crime victim's compensation, and aid to the blind, aged, and disabled, all enjoy at least partial protection from garnishment.Pensions or retirement benefits: many public worker pensions, such as those of city, town, and county employees, are protected from garnishment-anyone receiving a public pension in Virginia should check to see if it is exempt.Virginia also establishes other exemptions to garnishment-other sources or types income which are protected from being garnished.

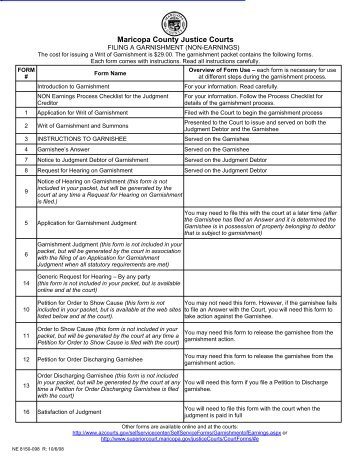

Virginia Garnishment Exemptions and Non-Exemptionsįederal law provides exemption for Social Security from most garnishment: it can be garnished only for child support, alimony, and a few federal debts, such as for income taxes. Any money belonging to a debtor in the control of a third party can be garnished when the garnishee is the debtor's employer, and the money owed debtor is his or her wages or salary, then it is called wage garnishment. In garnishment, the creditor doesn't look to get the money owed it directly from the debtor instead, the creditor gets an order requiring a third party, called a garnishee, to turn over to it money in the garnishee's possession or control which belongs to the debtor. Garnishment is one way that a creditor can seek payment from a debtor who is not voluntarily paying a monetary judgment (or court determination of an obligation to pay money).

0 kommentar(er)

0 kommentar(er)